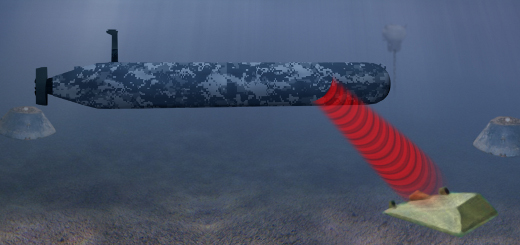

Report: Military UGV demand to shrink now, grow long-term

Military demand for unmanned ground vehicles will likely decrease in the short term, due to fiscal and military realities, but as UGV capabilities expand during the next decade, so will their use, according to a report released last week by London-based business information provider Visiongain.

The report, “Military Unmanned Ground Vehicle (UGV) Market 2013-2023,” predicts that reduced exposure of troops to IEDs and fiscal pressures across North America and Western Europe will lead to a near-term contraction of the market. To date, the most common use of UGVs has been explosive ordnance disposal (EOD) work; however, Visiongain notes that the capabilities of UGVs are expected to grow dramatically during the timeframe covered by the report. The group says this will lead to greater utility and — ultimately — generate greater demand.

The anticipated advancements may help address the criticism that UGVs are less capable than their airborne counterparts. The New York Times recently published a piece titled “Military Lags in Push for Robotic Ground Vehicles” that made the case that civilian projects such as Google’s self-driving car have started to eclipse military ground vehicle capabilities.

Certainly, spending on ground systems doesn’t compare to that of unmanned aircraft systems. Visiongain says global spending on military UGV will be $579.4 million in 2013, whereas more than $11 billion will be spent globally on UAS for defense in 2013, according to the Association for Unmanned Vehicle Systems International.

As UGVs grow in sophistication, it will be interesting to see if that gap persists or if ground systems begin to make up, well, ground.

For more on the Visiongain report, click here: Military Unmanned Ground Vehicle (UGV) Market 2013-2023

[ photo courtesy of Lockheed Martin ]